The PwC firms in those territories participated in that sale and no longer provide Global Mobility Services. Outside Malaysia not exceeding one passage in any calendar year is limited to a maximum of RM3000.

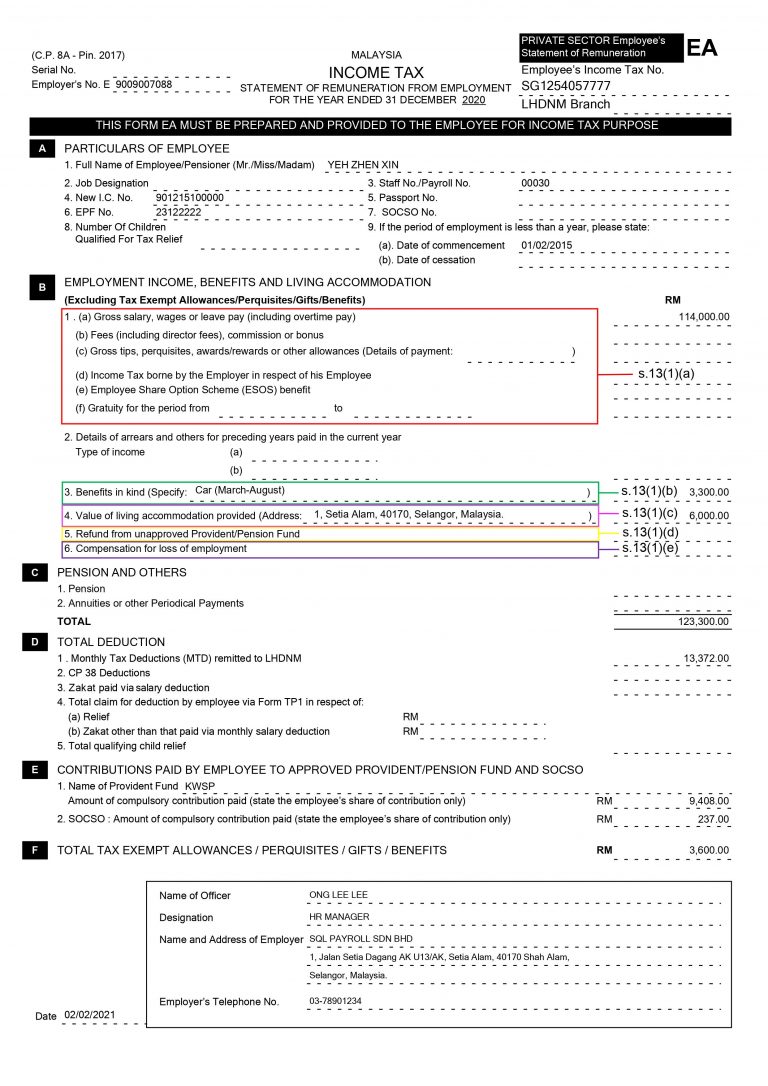

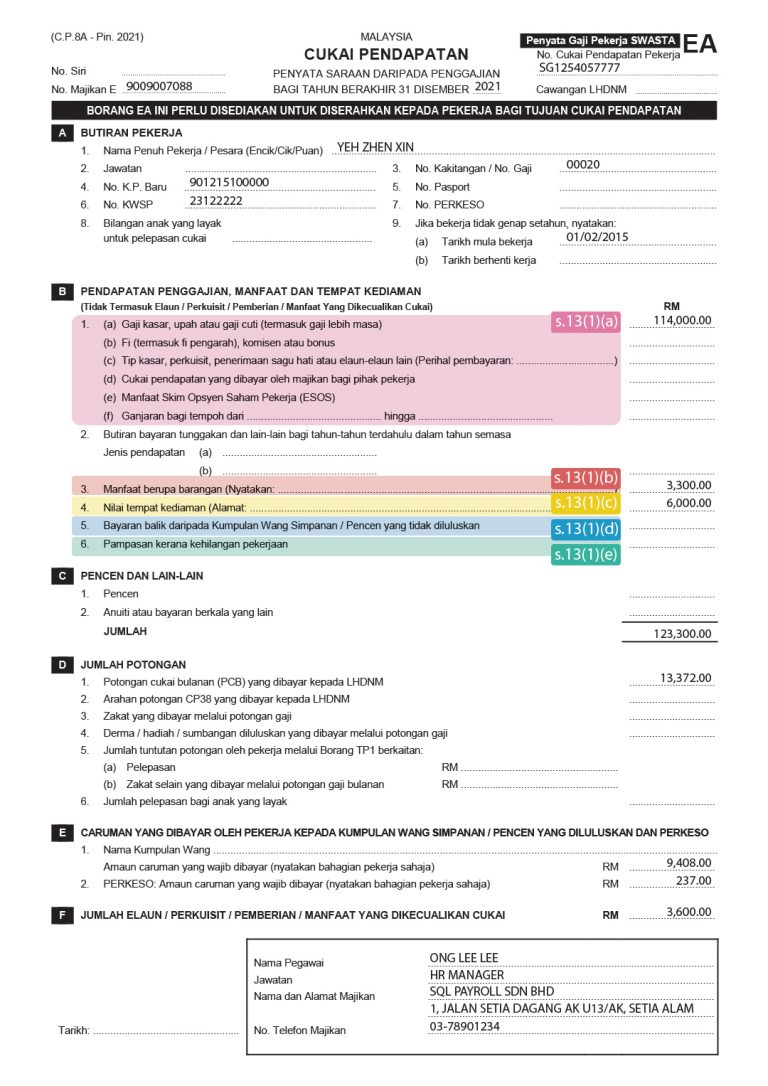

St Partners Plt Chartered Accountants Malaysia Form Ea 2021 Statement Of Remuneration From Employment For Private Sector This Form Ea Must Be Prepared And Provided To The Employee

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

. The programme combines much of the learning from EA Technologys extensive range of specialist technical short courses to give you an in-depth introduction. An Expatriate Guide to Starting a Business in Malaysia as Foreigner. According to section 21 Employment Act 1955 the EA as amended via the Employment Amendment Act 2012 a part-time employee means- a a person who has entered into an employment contract or a contract of service with an employer under which such persons wages do not exceed RM2000-00 a month including such person included in.

How to Set Up a Business. Iii Service provided free or at a discount by the business of the employer to the employee his spouse and. By 1 Mac you may skip the next step.

Now 2021 EA form number of this person should have the numbers that youre looking for. List of tax exempt allowances perquisites gifts benefits which are required to declare. Fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees.

As of April 29 2022 PwC firms in the territories listed below sold their Global Mobility Services businesses to Vialto Partners. Now go to Payroll-Form E page download the e-Data Praisi file and unzip it. If youve done the above correctly you should have EAE form numbers correct.

Tax Filing Deadline 2022 Malaysia Lhdn. Mahsa University provides industry based curriculum with high quality teaching methodology coupled with excellent facilities in Malaysia. Tax Filing Deadline 2022 MalaysiaThe Lhdn Could Choose To Have You Prosecuted If You Fail To Furnish Your Tax ReturnsThe Deadline For Be Is April 30The Deadline For Submitting Form E Is March 31Filing Of Return Form Of Employer Form E Must Submit Together With Cp8D Form.

Heres a masterlist of all. Fill in the below form to be contacted about more course dates or if you have any other enquiries. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

Eg submit CP8D instead of e-data praisi. Commonly Faced Problems by Foreigner When Doing Business in Malaysia. Notes for Part F of Form EA.

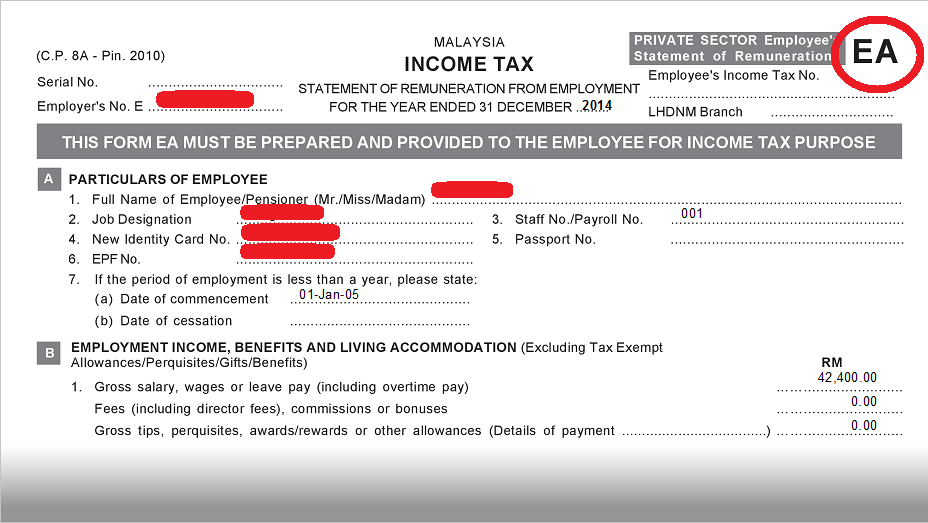

Ea Form Malaysia Form Ead Faveni Edu Br

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

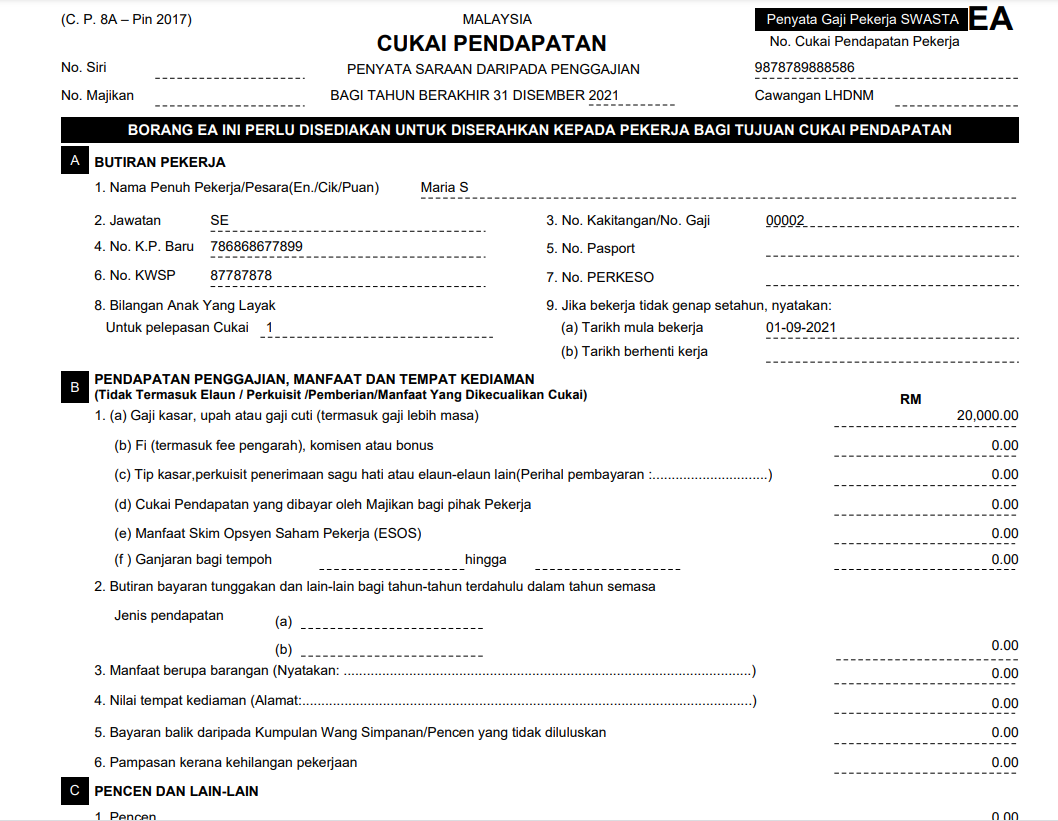

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Ea Form 2017 Excel Download Savannagwf

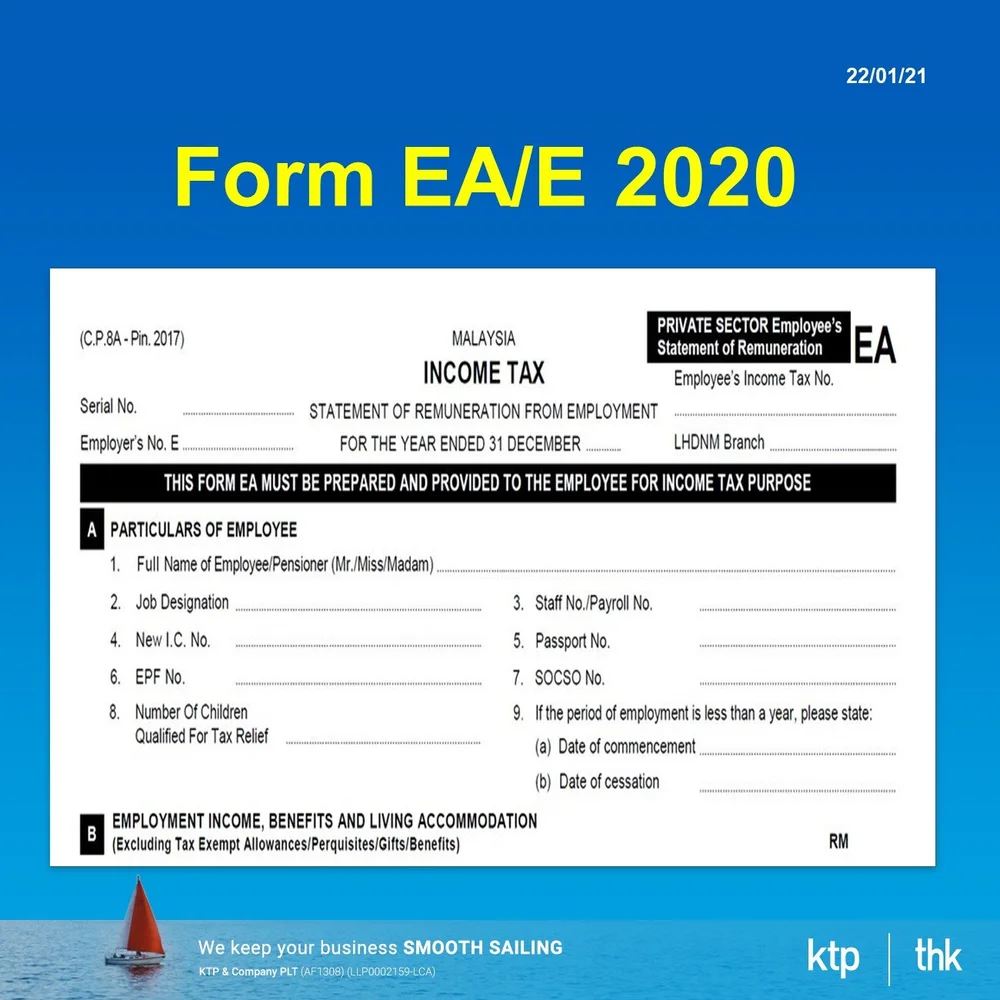

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People

Ea Form Malaysia Form Ead Faveni Edu Br

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Form Ea Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Function Added For Excel Users To Do Ea Form Actpay Payroll

Ea Form Sample Image From Actpayroll Com Cilisos Current Issues Tambah Pedas

St Partners Plt Chartered Accountants Malaysia Form Ea 2020 Statement Of Remuneration From Employment For Private Sector This Form Ea Must Be Prepared And Provided To The Employee

Ea Form Malaysia Form Ead Faveni Edu Br

Understanding Lhdn Form Ea Form E And Form Cp8d

Ea Form 2021 2020 And E Form Cp8d Guide And Download